Discover your perfect match

Compare many reputable NZ lenders.

Get your finance pre-approved through us comparing and choosing from a range of reputable lenders.

Then armed as a cash buyer, buy a car from our website, through a dealer or find one privately using our car buying app DealStrike

Buying a car should be fun & stress-free.

We've teamed up with loanoptions.ai to make it more simple for you.

Choosing the right loan can feel overwhelming with so many options out there. LoanOptions make it easy to compare lenders and secure the best loan in just seconds. No more spending endless hours on research! With LoanOptions, you'll have all the information you need right at your fingertips, making your car buying journey simple and stress-free, just as it should be!

GET PRE-APPROVED

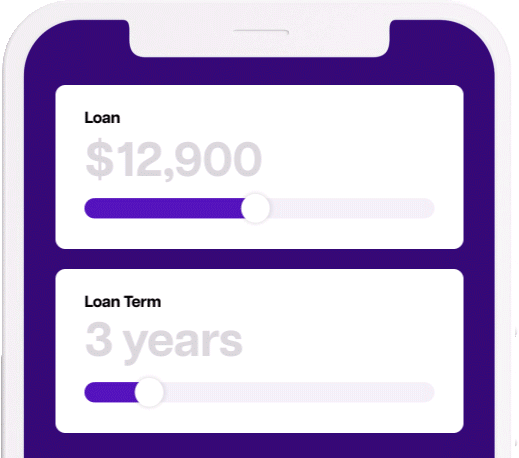

Step 1

Input.

Input your information in our AI options tool and it will calculate and present you with the best options available! Remember, the more information you provide, the more accurate your loan options will be.

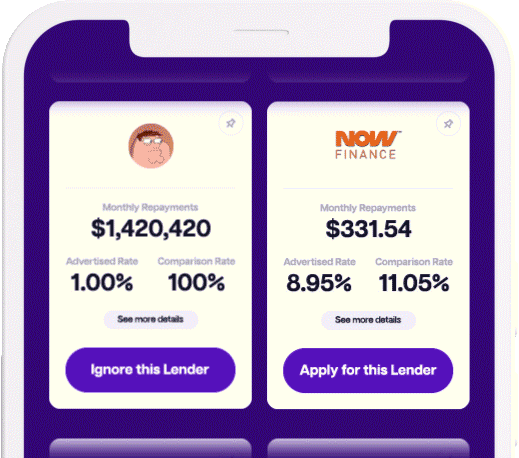

Step 2

Compare.

Let our AI options tool do the work instantly! No waiting around! With many Lenders, our AI options tool will curate and personalise the best results based on your priorities.

Step 3

Your Choice.

Now the easy part! Pick from the list and if you need further clarity, the platform can provide you with a granular level of detail to help find what you are looking for. For a more personal touch our Customer Service Consultants are available to talk to you.

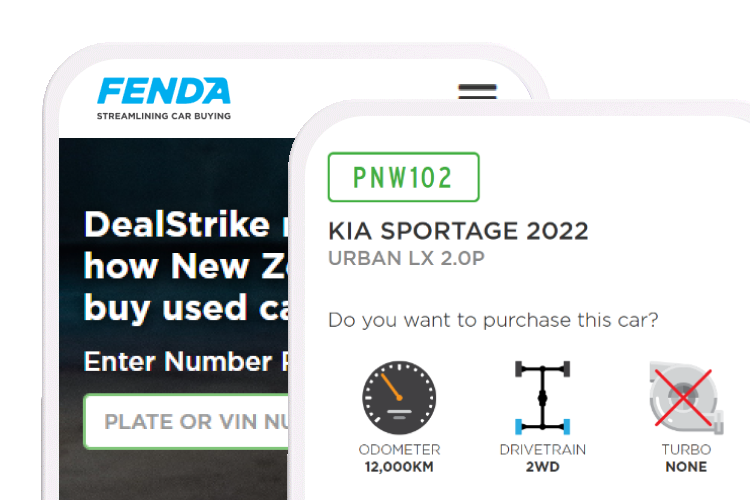

With your pre-approved loan from LoansAI (we give you a pre-approval code) you can then buy a car using DealStrike.

Whether you’re buying privately or through a dealership, DealStrike can help you buy a used car safely and with peace of mind. Start your car-buying journey in three easy steps:

Step 1

Enter the license plate number of the car you want to buy.

Step 2

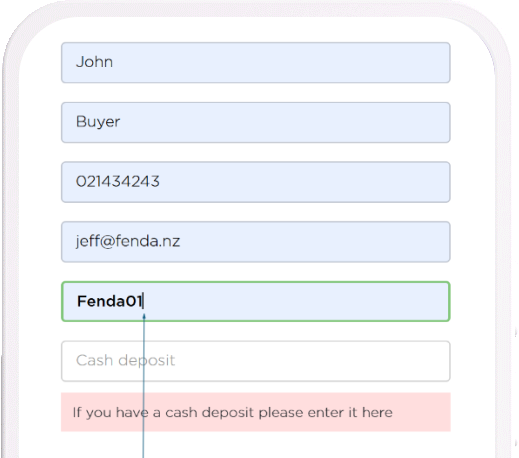

Enter the seller’s details.

Here you can enter our Pre-Approval Code.

Step 3

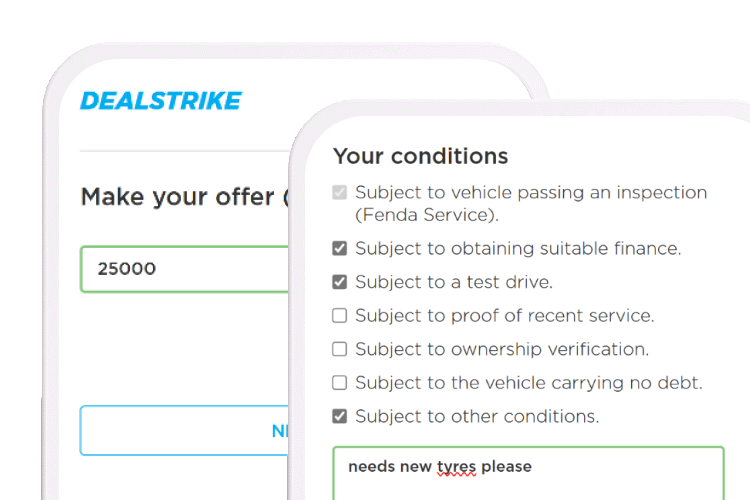

Make an offer!

Include any deal conditions (eg. must come with new tyres, must come with new WOF).

Everything about cars loans

Reasons for a car loan

Feel like your car could do with an upgrade? Sick of riding Uber? Want to save the environment by purchasing an EV but you can’t afford it? A car loan could be the answer. That’s just one reason but there are many why taking out a car loan can be a good idea.

The importance of research

No matter your reasons, it’s important to do your research on what loan suits you best. And everybody knows that research takes forever! With LoanOptions you can compare and find the best loan for you within seconds! The car buying journey should be a fun one, stress free and with all the information at your fingertips. Cuz that's the way it should be!

Savings

Put more money back in your pocket to cover extra costs like insurance, maintenance, or even upgrades to make your used car truly yours.

Credit score

You want to build your credit score, to get yourself the best deal. Better scores, better deals

You need a ride

You simply just need a sweet new ride